- Home

- Environmental Sustainability Force

- Climate Change Management

Climate-related Financial Disclosure (TCFD) and Governance

The Company pays attention to climate risks and refers to the relevant provisions of the “Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)” published by the Financial Stability Board (FSB) in June 2017. The Company should identify the transition and physical risks of climate change in accordance with the TCFD framework, conduct financial impact assessments for high-risk factors, and incorporate climate change risks into its existing risk management framework to facilitate long-term tracking and ensure effective governance of climate issues.

The Company adopts the ESG sustainability organizational structure as the climate governance framework, and enhances climate risk and opportunity management through mechanisms such as identifying climate-related risks and opportunities and setting carbon reduction targets, continuously responding to the concerns and expectations of the government and other stakeholders regarding the Company’s climate governance. The ESG Committee reports the governance performance of climate issues to the Board of Directors, with the Board of Directors overseeing, deciding on, and managing climate-related issues. The responsibilities of the iST’s climate governance organization are as follows, with the climate change response and green sustainability management group serving as the dedicated unit for promoting TCFD.

According to the recommended climate-related financial disclosure (TCFD) framework, the disclosure matters are as follows:

iST Management Strategy and Action

● Board of Directors

The Board of Directors serves as the highest climate governance decision-making body of the company. It oversees the company’s performance and progress toward goals related to climate issues, and conducts annual reviews of its sustainable governance performance. The review includes the current status of governance and progress toward the goals related to climate issues. In 2024, we reviewed the annual energy conservation, carbon reduction, and water conservation targets related to the Company’s climate initiatives. At the same time, we consider climate-related issues when reviewing the Company’s important capital expenditures, annual budgets, and business plans.

● ESG Steering Committee

An ESG Steering Committee is established under the Board of Directors as the highest-level guiding body for implementing sustainability initiatives and making decisions regarding ESG activities and policies. The committee reviews and approves the sustainability report, is composed of directors, and reports annually to the Board of Directors on the management performance of climate-related risks and opportunities. The Risk Governance Team is responsible for collecting and compiling domestic and international climate issue trends, and for regularly formulating the Company’s overall climate risk and opportunity management policies and response strategies, ensuring the Company’s climate governance direction and implementation are appropriate. In 2024, the annual results of climate initiatives and the net-zero emissions action plan were reported to the Board of Directors.

● ESG Committee

The ESG Committee is established under the ESG Steering Committee and chaired by the Chairman. The heads of the departments act as the committee members. The Committee integrates ESG strategies and resources across departments, with the convener leading the ESG Secretariat to coordinate and promote ESG policies and activities. The ESG Committee reports to the ESG Committee and the Board of Directors on a regular basis regarding material ESG issues of concern to stakeholders, along with their implementation results. Regular meetings are held to review ESG goals and the progress of related activities, ensuring effective implementation of the sustainability policies.

● Environmental Safety and Health Subcommittee

Responsible for identifying and assessing climate-related risks and opportunities, and regularly compiling and analyzing climate-related indicators and targets, such as energy resource usage and carbon emissions, to assist in adjusting and formulating climate governance strategies. In 2024 year, the Subcommittee reported sustainability performance, including responses to climate risks and opportunities, to the ESG Committee and discloses it to stakeholders through appropriate channels.

Strategy

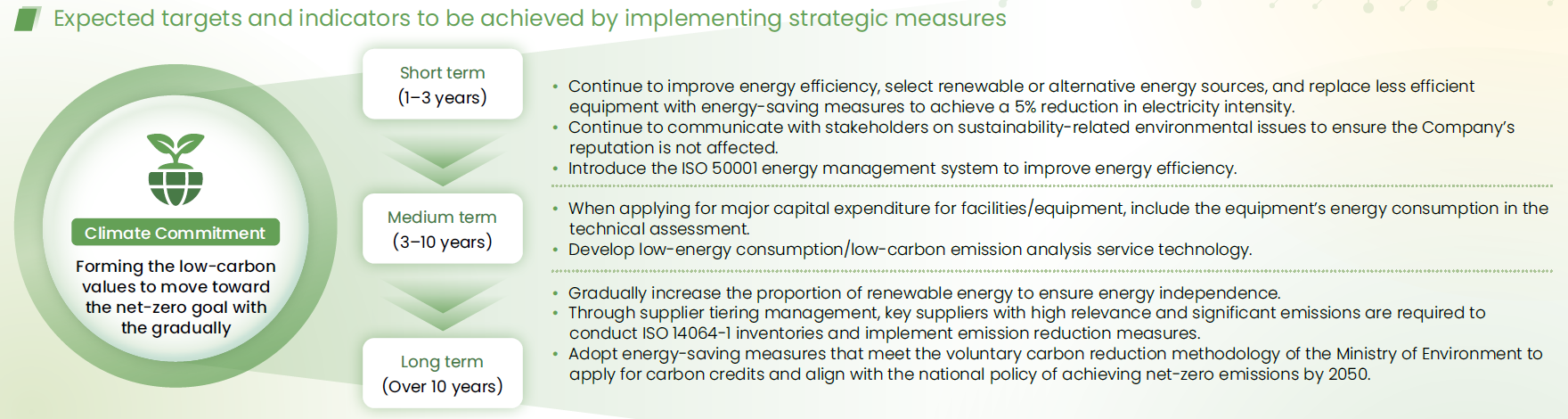

- According to the iST’s climate change risk and opportunity assessment methodology, short term is defined as within 3 years, mid-term is within 6 years, long-term is within 10 years, and beyond 10 years is also considered long-term.

- iST’s sustainable policy of “forming the low-carbon values to move toward the net-zero goal gradually” is adopted as the guiding principle.

- The Company assesses the impact of climate change risks and opportunities on iST’s operations based on the TCFD framework.

- Climate risk analysis is conducted based on different scenarios, including the transition scenarios of AR6 SSP1-1.9 (temperature rise of 1.2°C to 1.7°C in 2040) and AR6 SSP5-8.5 (temperature rise of 1.3°C to 1.9°C in 2040) as outlined by the Intergovernmental Panel on Climate Change (IPCC).

Risk management

- The Company analyzes the risks and opportunities arising from policies, laws and regulations, market dynamics, technology, goodwill, and physical risks potentially resulting from climate change.

- The subcommittees under the ESG Committee conduct risk management and implement response measures for climate factors identified as high priority. The overall assessment results and related measures are reported to the ESG Committee.

- The Company checks the changes in policies, laws, technology, markets, and goodwill annually regarding transition risks and opportunities; reviews the assessment results of physical risks, transition risks, and opportunities every three to five years, coinciding with updates to the IPCC climate scenarios and the Taiwan Climate Change Projection and Information Platform (TCCIP); and implements rolling revisions.

Metrics and goals

- iST has established assessment and management indicators for climate-related risks and opportunities, including water consumption, energy usage, and greenhouse gas emissions.

- The information on the relevant emissions has been checked in accordance with the Greenhouse Gas Protocol and ISO 14064-1 standard, and third-party verification has been commissioned.

Climate risk and opportunity identification process

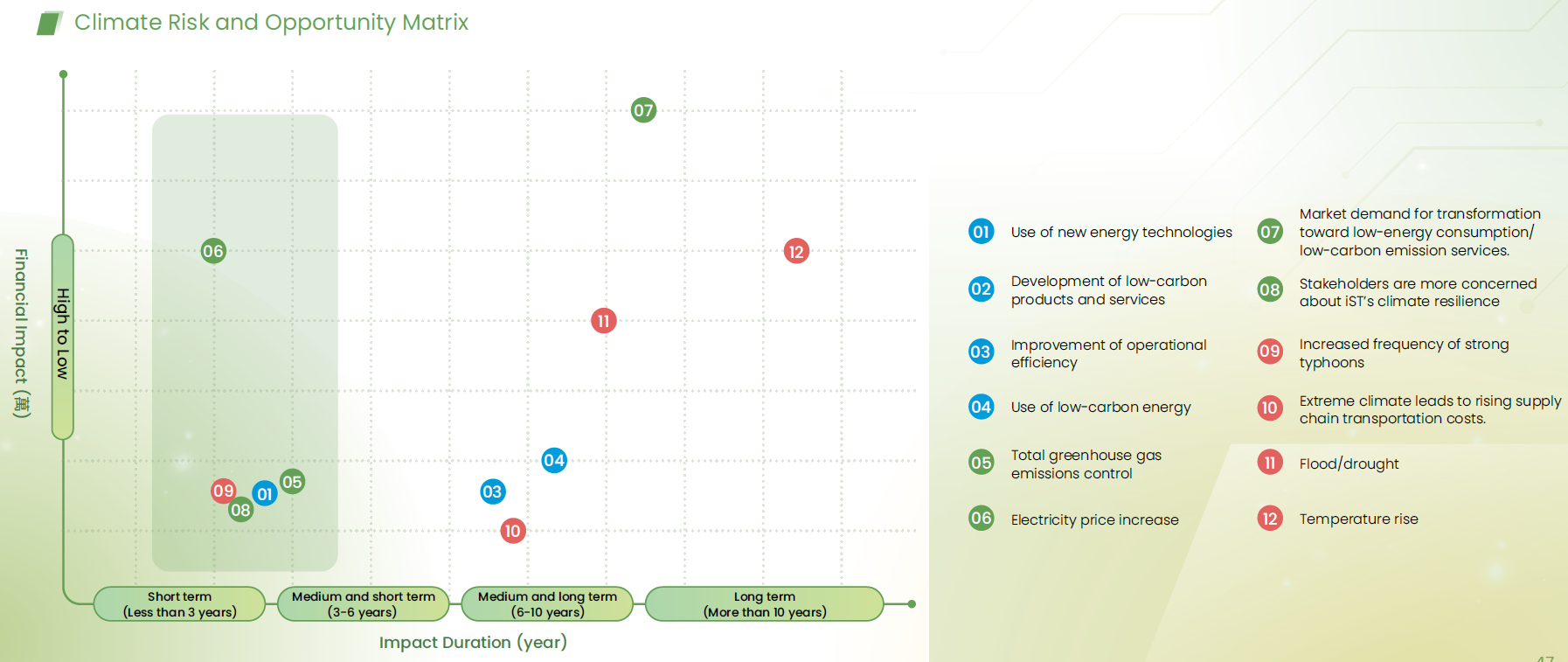

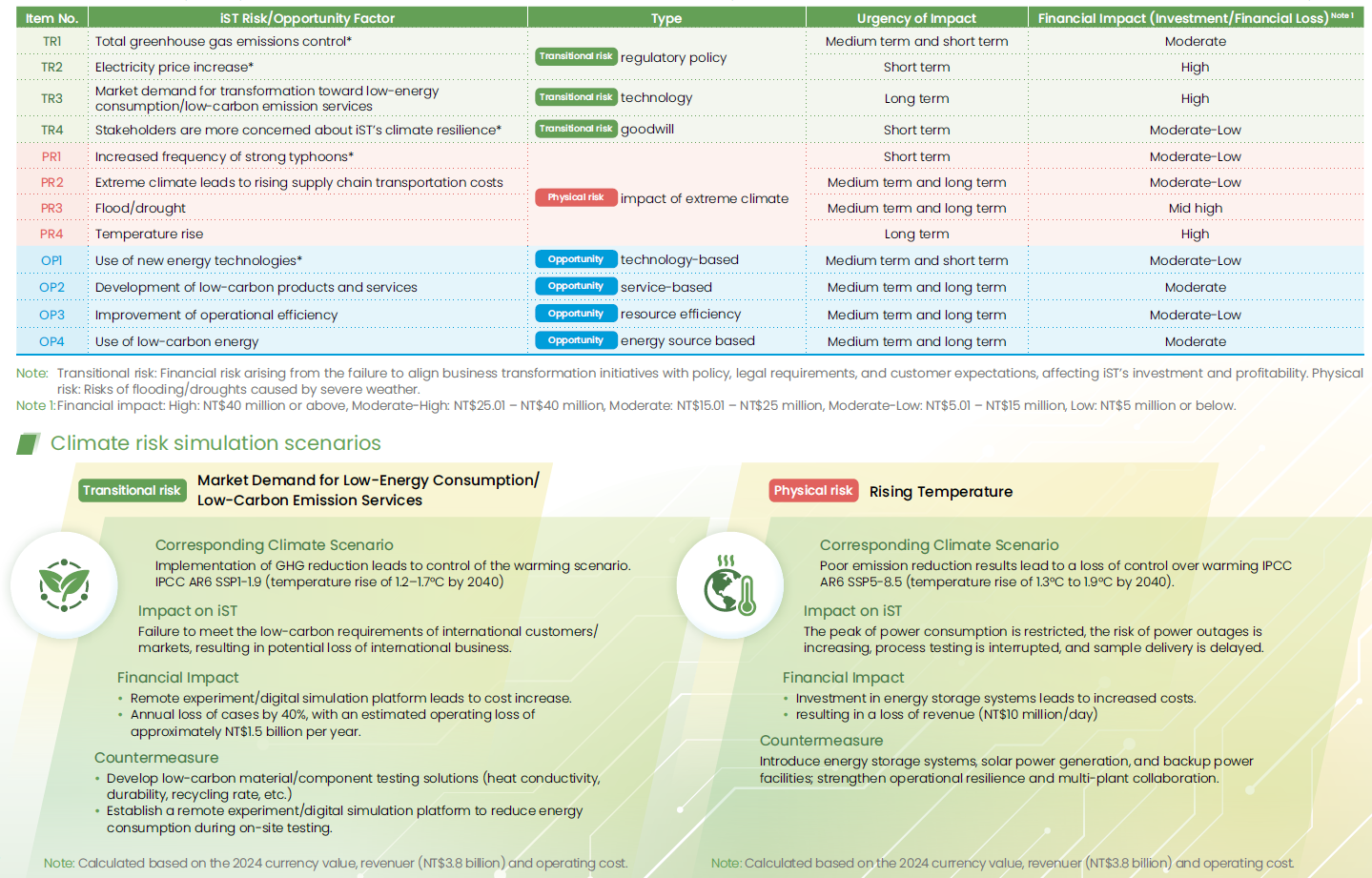

The Company further narrowed down the climate risk and opportunity factors identified by the ESG Steering Committee into 12 factors based on their risk characteristics and impact on the industry, supply chain and R&D related functions of the Company. These factors are then compared and reviewed against the materiality and benchmark company results identified by internal experts to make sure the impact on climate governance and make adjustments in materiality. Based on the identification results, 5 items are distributed over the short term to medium term, 5 items are distributed over the medium term and long term, and 2 items are distributed over the long term. Their distribution locations are detailed in the climate risk matrix below.

iST Climate Risk and Opportunity Factors List

In response to climate issues, we conducted a resilience analysis in consideration of the risks we are facing and our risk tolerance to develop a list of 12 climate risk and opportunity factors as follows. After considering the urgency of the impact and those on the finance, we launch a risk management plan for one opportunity and four risk issues (marked with * in the following table):

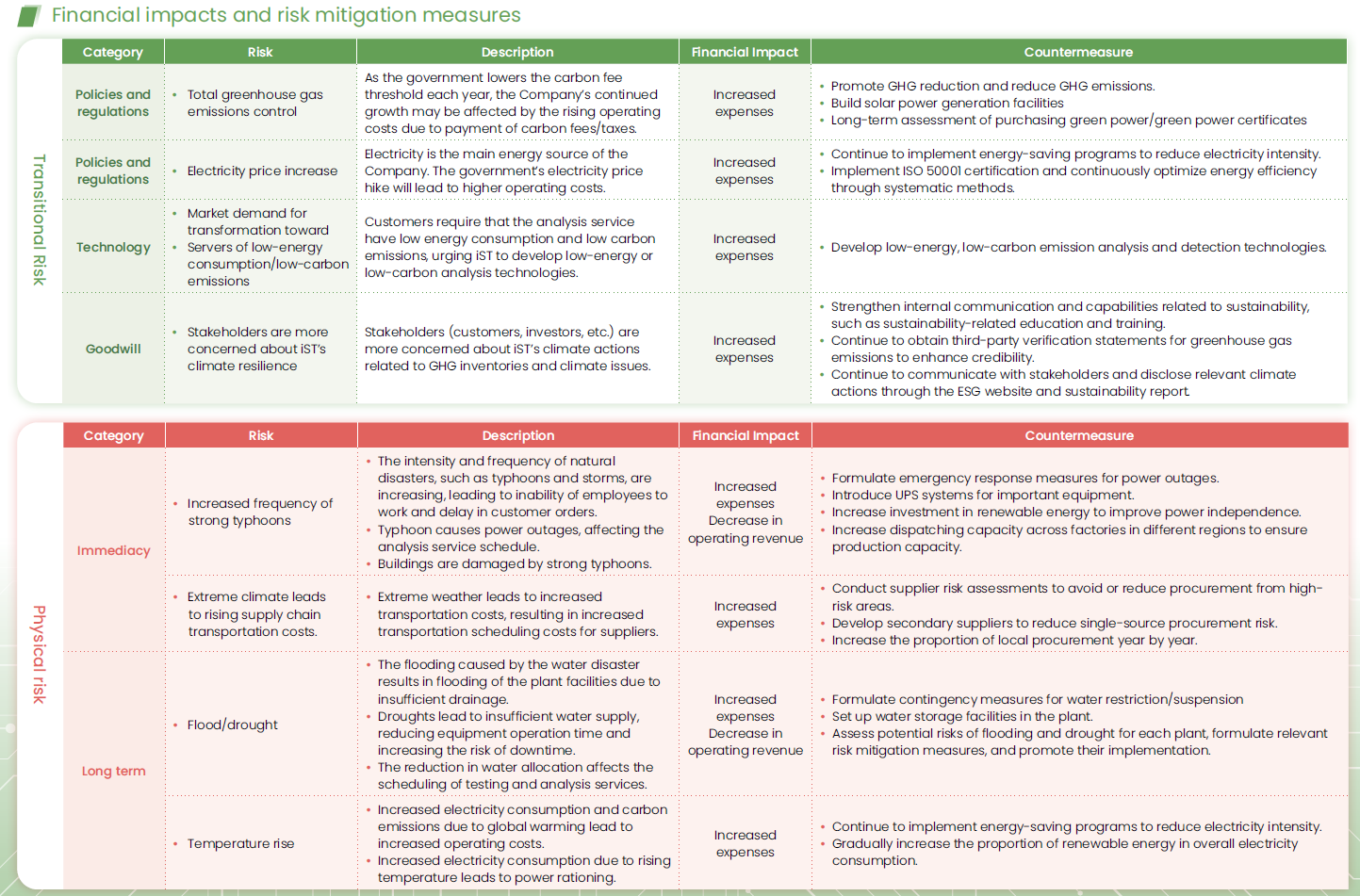

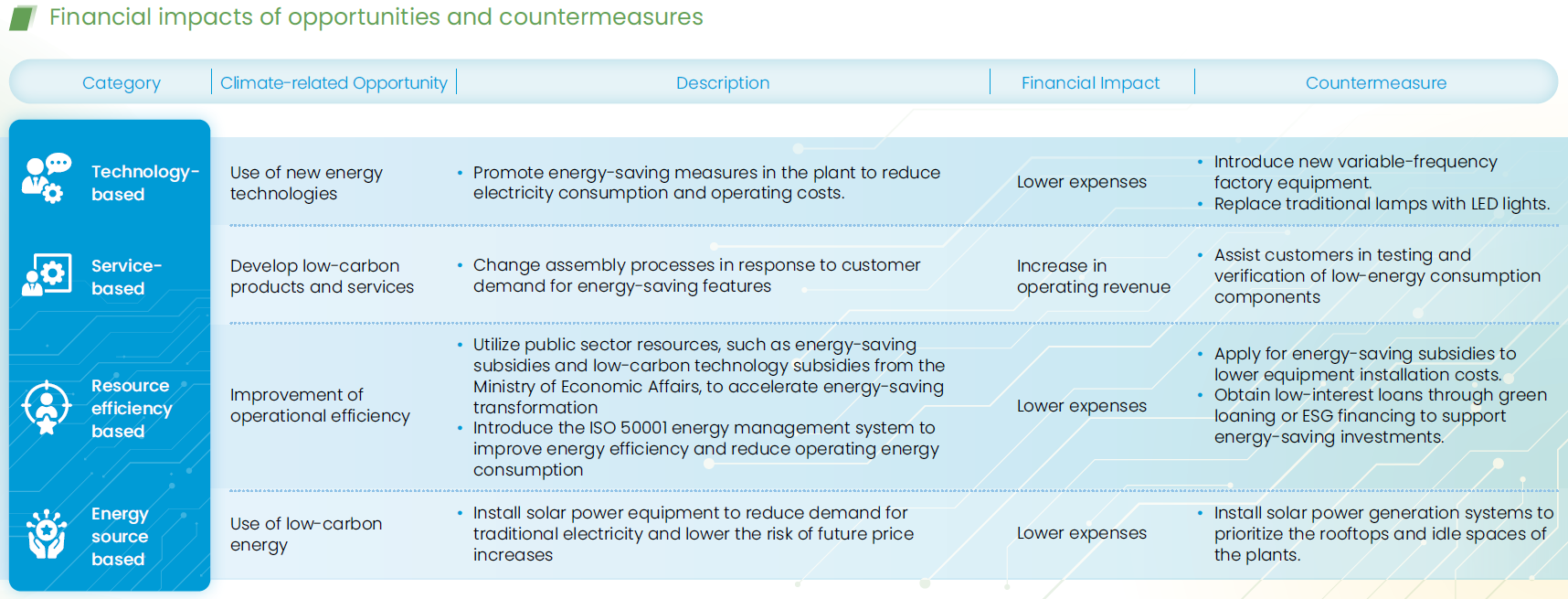

Based on the above climate risk identification, the following climate factors, identified as high priority, are further described in terms of their risk implications and financial impacts on iST, along with the countermeasures taken by the Company.